If you have renter's insurance, you should also renew it. Here's how to carry it out:.

List all of your possessions.

There are a few things you should do ahead of time, regardless of whether you're moving out of an old apartment or a dorm room. For instance, as soon as feasible, provide your notice to your landlord or present apartment manager if you haven't already.

Additionally, you should schedule your utilities at your new residence so that they start running the day you move in. You'll probably need to give the utility company a call or go to their website for this. Doing this as soon as possible is a smart idea, especially if you're concerned that the process may take longer than anticipated.

Next, begin packing up anything that you won't need right away following the relocation. This could contain books, out-of-season clothes, and decorative pieces like wall art or trinkets. You can reduce stress during the move and clear up clutter by packing these goods in advance. A box containing kitchen goods (plates, silverware, etc.), towels, and cleaning supplies should also be set aside.

Speak with your insurer.

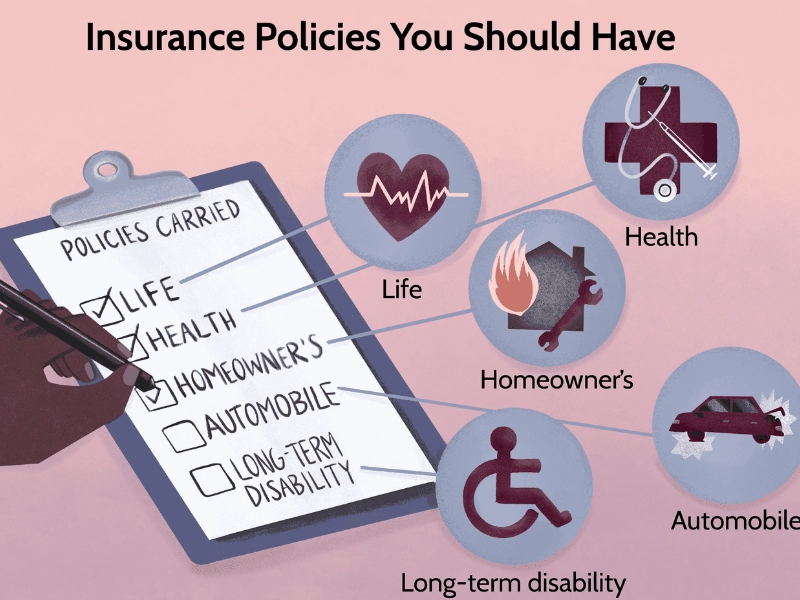

It is important for tenants to understand that renters insurance policies often provide two types of coverage for their personal belongings: replacement cost value (RCV) and actual cash value (ACV). It's a great idea to include this insurance on your move-in checklist to safeguard against unanticipated costs and losses.

Make sure you've chosen the proper deductible and that your coverage amounts correspond to the value of your property. Additionally, keep in mind that submitting a claim may result in a rise in your premium; therefore, evaluate if the dollar amount of the damages justifies the higher rate.

If your claim involves theft, vandalism, or burglary, get in touch with the police right away so they can record the event. This is necessary in order to process your claim. Additionally, before making any settlements, the majority of insurers will request to see the police report. Don't forget to preserve copies of all supporting documents. In an emergency, having all of this information in one location will save time and money.

Revise your address.

Changing your details with the post office, banks, credit card companies, auto loan providers, subscription services, and other organizations is crucial, regardless of whether you're relocating to a new apartment or just changing your address. In order for them to forward mail to your new address, you should also let your friends and relatives know that you are moving.

Plan your viewings.

Make appointments to view possible flats with landlords or property managers while you're apartment hunting. Examine every house carefully, taking note of its condition, design, amount of natural light, noise level, and parking availability. Inquire about the building's amenities, terms of lease, and upkeep guidelines.

Take photos of your new flat before you move in to record any previous damage. This can help you get your security deposit back and shield you from being held accountable for any unanticipated damages after your move-out date. This is a particularly crucial stage for those who share a room. Setting up all utilities in your name as of the day you move in is also a smart idea.

Examine your policy.

The declarations page (also known as the DEC page) of most policies contains a quick reference list of your basic coverage categories and limits. It also shows who, including roommates, is covered by the policy. Make sure to include your roommates as an insurable interest in your renters insurance policy if you're moving in a group. Unless they are specified as covered individuals, roommates will not be allowed to make claims under the policy for their personal belongings or responsibilities.

It's also a good idea to check the policy's coverage amount and deductible. You may frequently change to higher levels for a comparatively minor additional expense, and your existing deductible might not cover sufficient for your new place. Additionally, you want to check the coverage amounts for extra living expenses and personal items. For these costs, many policies provide a fixed sum of money or a percentage of your personal property limit. If necessary, you can usually get additional ALE coverage. Additionally, some insurers provide replacement cost coverage for personal property rather than actual monetary worth, giving you greater peace of mind in the event that your possessions are lost, stolen, or damaged.

Recommended Reading: Utilize A Refinance Calculator To Find Out How Much You Could Save On A Mortgage Refinance

Surfaces incremental value early.